2025 Lifetime Gift Tax Exemption

2025 Lifetime Gift Tax Exemption - Lifetime Exemption Increase 2025 Jodie Pierette, As of 2025, the lifetime exemption is $13.61 million per individual. Annual Gifting For 2025 Image to u, In general, the gift tax and estate tax provisions apply a unified rate schedule to a person’s cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

Lifetime Exemption Increase 2025 Jodie Pierette, As of 2025, the lifetime exemption is $13.61 million per individual.

Annual Federal Gift Tax Exclusion 2025 Niki Teddie, In 2025, the lifetime gift tax exemption is $13.61 million per individual.

What Is The Gift Tax Limit For 2025 And 2025 Lark Sharla, There's no limit on the number of individual gifts that can be made, and couples can give.

Lifetime Estate And Gift Tax Exemption 2025 Nancy Valerie, Lifetime irs gift tax exemption.

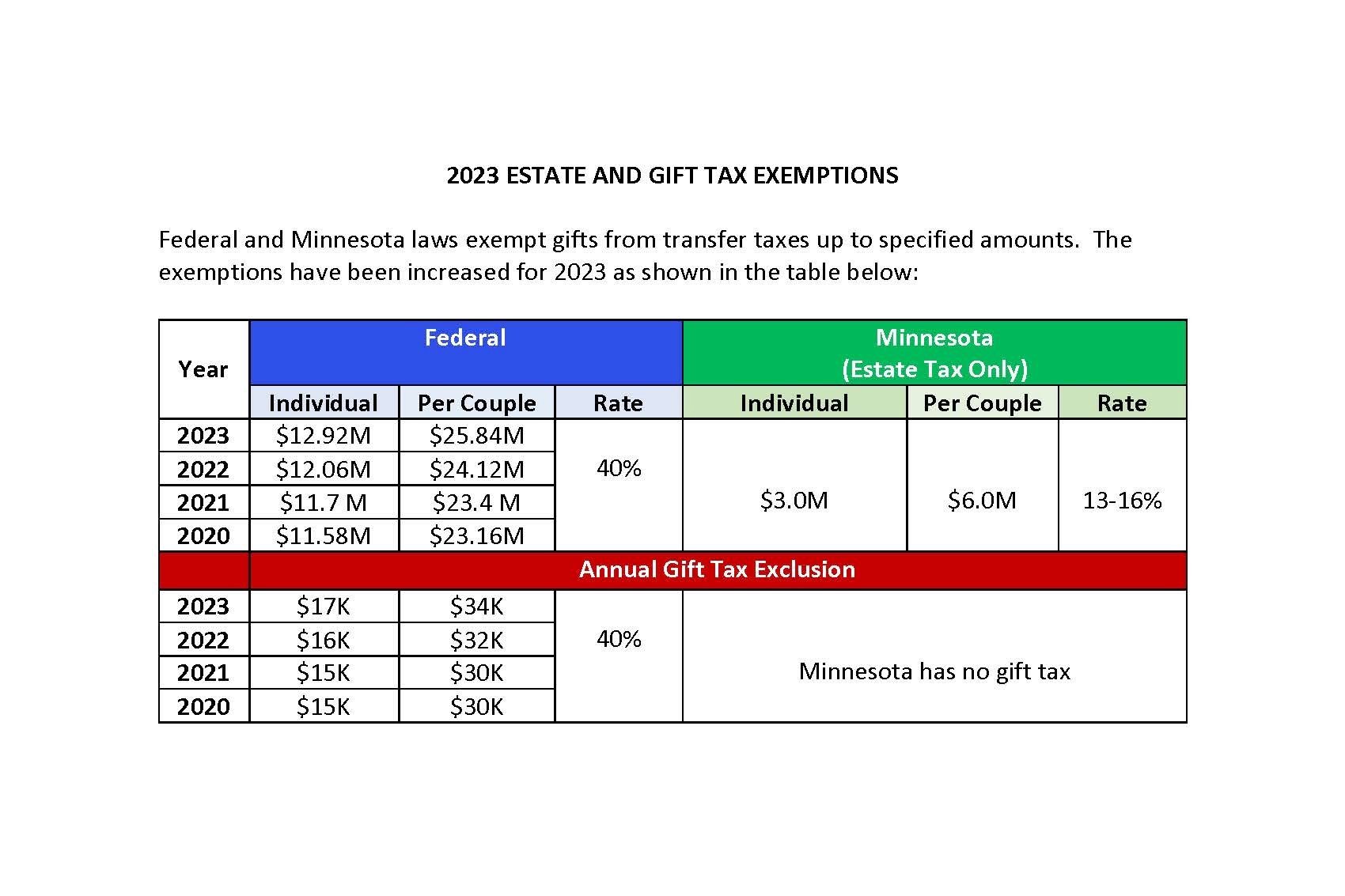

2025 Lifetime Gift and Estate Tax Exemption Update Davis+Gilbert LLP, The 2025 annual exclusion amount will be $18,000 (up from $17,000 in 2025).

.jpg)

This means that each person can. In 2025, the lifetime gift tax exemption is $13.61 million per individual.

Gift Lifetime Exemption 2025 Ertha Jacquie, In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

What Is The Gift Tax Limit For 2025 And 2025 Jena Robbin, The lifetime gift tax limit for 2025 is $13.61 million, up from $12.91 million in 2025.

2025 Lifetime Gift Tax Exemption. In 2025, the lifetime gift tax exemption is $13.61 million per individual. The irs has increased the estate, lifetime gift, and gst tax exemption in response to inflation rates in 2022, offering an opportunity to preserve wealth for.

2025 Lifetime Gift Tax Exemption Kacey Mariann, In addition to the annual gift tax exclusion, you get a lifetime gift tax exclusion.

2025 Lifetime Gift Tax Exemption Kacey Mariann, This means that each person can.